Empowering the P&C Insurance Industry with ClaimDeck and AI Tools

By Dwayne Hermes

Executive Summary

The 2023 US P&C Insurance Market Report by S&P Global Market Intelligence has revealed a turbulent time for the P&C industry, marked by historic profitability followed by significant challenges in 2022. This white paper analyzes these findings and proposes a robust solution.

By integrating litigation management technology like ClaimDeck and AI tools like ChatGPT, the industry can not only navigate these challenges but thrive. These technologies present a promising path toward sustained profitability and innovation by attracting talent, minimizing leakage, and streamlining efficiency.

Introduction

The U.S. Property & Casualty (P&C) Insurance Market has encountered unprecedented challenges and opportunities. After a continuous streak of underwriting profits, unexpected structural issues emerged in 2022. This paper will explore these findings and investigate how ClaimDeck and AI tools like ChatGPT can offer solutions.

The Historical Profit Streak and Sudden Challenges

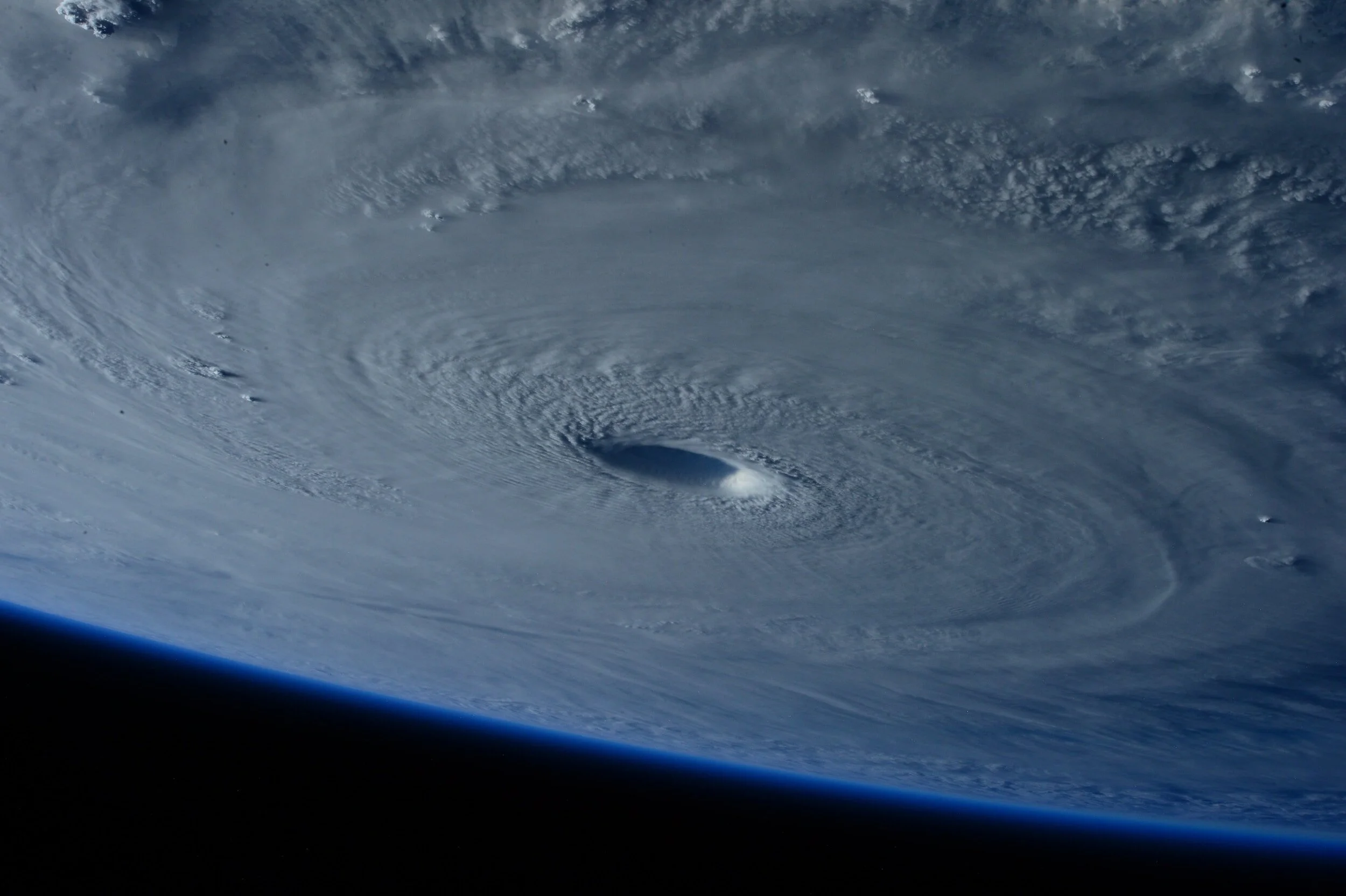

2021 stood as a landmark year, marking the fourth consecutive annual underwriting profit for the P&C industry with a combined ratio below 100%, the longest in over 50 years. However, 2022 saw these gains abruptly reversed. A series of devastating events, including Hurricane Ian, destructive storms in the Midwest, and adverse private auto results, led to a combined ratio spike to nearly 102.6%. The impact was so significant that it offset the benefits of previously favorable underwriting results in commercial casualty lines.

Combined Ratio Spike to nearly 102.6%

Facing Employee Cost Pressures

The industry's labor cost challenges have been another focal point. While the US Bureau of Labor Statistics showed rapid increases in employee costs across various categories, P&C insurers managed to restrain this expense category in 2022. The industry found ways to mitigate these cost-related challenges by utilizing technology and outsourcing.

ClaimDeck: A Comprehensive Solution

ClaimDeck offers a tailored solution to the challenges presented above. It's more than a tool; it's a strategic asset. Its best-in-class technology not only attracts top talent but also fosters a culture of innovation. This enhanced culture, in turn, boosts morale and reduces turnover costs.

Leakage, a critical concern for insurers, can be minimized with ClaimDeck. Through comprehensive data analysis, carriers can pinpoint and rectify leakage points, ensuring accurate settlements.

Inefficiency has plagued the management of litigated claims.

ClaimDeck's centralized platform streamlines the process, reducing errors, enhancing accuracy, and cutting costs.

Read more about the benefits here.

The Role of AI: ChatGPT

The potential of AI tools like ChatGPT is also part of the solution. By enhancing human judgment, AI can offer insights leading to better decisions.

The sophisticated application of AI and granular structured data captured by platforms like ClaimDeck places powerful evaluative tools at the "point of work."

A New Era for the P&C Industry

The 2023 US P&C Insurance Market Report paints a picture of an industry at a crossroads. The challenges are significant, but so are the opportunities.

By embracing ClaimDeck and AI tools like ChatGPT, the P&C industry can weather the current storm and set sail into a new era of resilience, efficiency, and success.

The integration of these technologies symbolizes the fusion of human intuition with the precision of AI, laying a foundation for sustained growth and innovation.

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Contact Dwayne at dwayne@claim-deck.com.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.