Fighting Back Against Litigation Finance: A Strategic Blueprint for Insurers and Claims Leaders

By Dwayne Hermes

Over the last decade, the insurance industry has witnessed an unprecedented surge in litigation costs. Jury verdicts have ballooned, with so‑called “nuclear verdicts” in excess of $10 million becoming all too common. Simultaneously, third‑party litigation finance (LitFin) has matured into a $3 billion–plus asset class in the United States. By providing capital to plaintiffs in exchange for a share of any recovery, litigation funders remove traditional barriers to filing—driving up litigation frequency, emboldening risk‑seeking behaviors, and magnifying social inflation.

While some funding helps genuinely under‑resourced claimants obtain counsel, the vast majority of LitFin‑backed matters pressure insurers into high‑cost defenses or settlements on claims that lack strong merit. For insurers—already grappling with rising loss costs—LitFin has become a critical driver of premium inflation, shrinking profitability, and mounting regulatory scrutiny.

In response, industry leaders such as Chubb, Skyward Specialty, Nationwide, and Aon have publicly decried litigation finance’s negative externalities and begun to take concrete steps to limit their exposure. At the same time, plaintiff‑side innovators have rolled out AI and legal‑tech tools—well‑capitalized by the same financiers—in an arms race of speed and data‑driven advocacy. Insurers and their claims and legal operations must now formulate a robust defense‑side response strategy that leverages modern technology, data analytics, and cross‑industry collaboration.

Litigation Finance: Scope, Scale, and Public Policy Implications

Rapid Growth & Capital Inflows

In 2022, U.S. LitFin deals attracted $3.2 billion in new capital (Westfleet Advisors).

Global LitFin assets under management now exceed $20 billion, with funders targeting personal injury, mass torts, and commercial disputes.

Social Inflation & Nuclear Verdicts

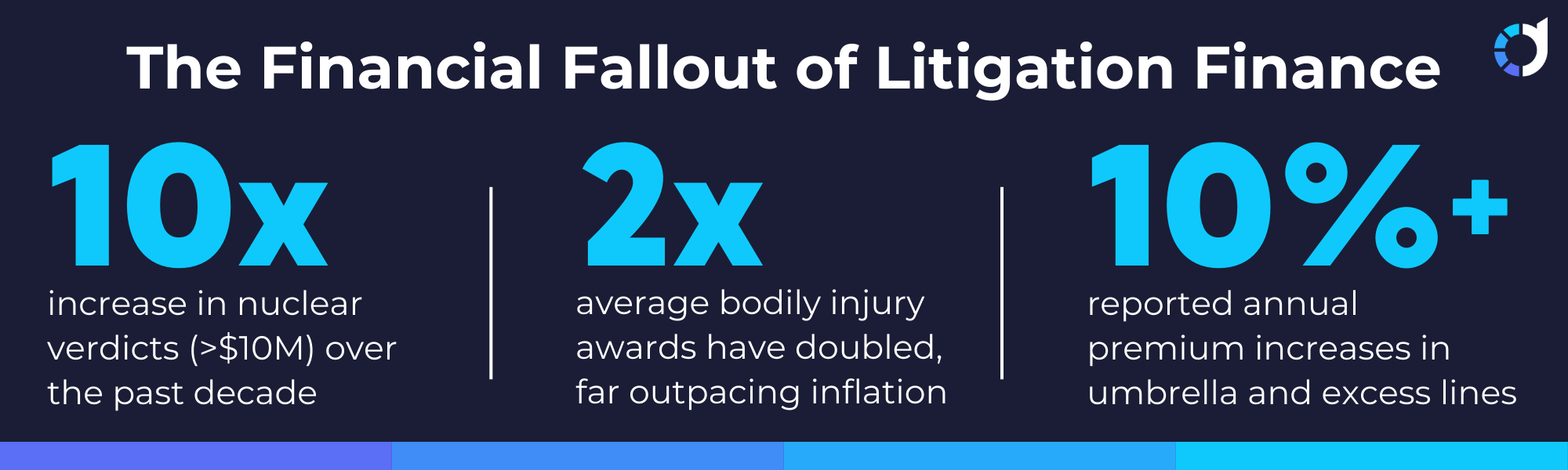

“Nuclear verdicts” (>$10 million) have grown tenfold in the past decade.

Average bodily‑injury awards have doubled, far outpacing the Consumer Price Index growth.

Insurers report premium increases of 10%+ in umbrella and excess lines to keep pace with loss trends.

Public Policy Concerns

Economic Drag: Excessive litigation inflates costs for businesses, diverts capital from innovation, and increases consumer prices.

Access vs. Abuse: While LitFin can enhance access to justice, it also finances marginal and low‑merit suits aimed at financial return, not remediation.

Transparency Deficits: Jurors and insurers often remain unaware of which funder stands to gain, complicating risk assessment and undermining trust in verdicts.

Regulatory Momentum

Proposals for mandatory disclosure of funders at case inception (Florida SB 1276, U.S. Chamber Institute for Legal Reform).

Growing calls for tort‑reform measures: early case screening, fee‑shifting, and caps on non‑economic damages.

Chubb, Skyward, Nationwide, and Aon Statements: What They Signal

Chubb

(Evan Greenberg)

Labelled LitFin “against society’s interests” and “like eating your own seed corn.”

Threatened to sever ties with any suppliers profiting from LitFin—from asset managers to law firms and brokers.

Urges industry‑wide refusal to work with or invest in LitFin entities, and legislative mandates for funder disclosure to juries.

Nationwide

(Russ Johnston)

Warned LitFin fuels low‑merit suits, nuclear verdicts, and an impending umbrella policy affordability crisis—premiums could double in 5–7 years.

Advocates proactive risk management: mock trials, jury consultants, early AI‑powered claim scoring, and policyholder education on funding risks.

Supports disclosure requirements and legislative transparency as guardrails against funding abuse.

Skyward Specialty

(Andrew Robinson)

Conducted supplier reviews, terminating relationships with investors tied to LitFin—despite indirect exposure.

Characterized the system as “broken,” calling for comprehensive tort reform alongside supplier actions.

Will no longer place litigation‑funding insurance for U.S. or international funders of U.S. personal‑injury cases.

Reflects mounting unease about social inflation and risk underwriting in the face of capital‑backed plaintiffs’ bar.

Takeaway:

The industry’s leading carriers and brokers acknowledge LitFin’s systemic threat—moving from rhetoric to tangible policies that reject funding‑linked business and push for regulatory reform.

The Rise of Plaintiff‑Side Tech Solutions and Spillover Risk

As LitFin has matured, so too has the sophistication of plaintiff‑side legal‑tech:

Generative AI Assistants (e.g., EvenUp’s Piai™): streamline demand‑letter drafting, identify missing documents, and optimize negotiation strategies—leading to up to 30% higher settlements.

Claims Intelligence Platforms: harness large language models (LLMs) and retrieval‑augmented generation (RAG) to analyze thousands of cases and millions of records for pattern discovery and predictive insights.

Automated Document Generation: accelerate motions, depositions, and discovery requests with minimal human intervention.

Spillover Risk: Many of these tools—funded by the same capital pools backing LitFin—are being repackaged for defense use or integrated into carrier‑sponsored initiatives without critical oversight. Insurers risk:

Vendor Capture: Relying on tools whose economics tie them to plaintiff‑funding interests.

Data Privacy & Ethics: Exposing confidential claim data to platforms originally built for opposing counsel.

Strategic Misalignment: Adopting point solutions that solve narrow tasks but fragment workflows and dilute carrier oversight.

Matching Innovation: Defense‑Side Tech as a Countermeasure

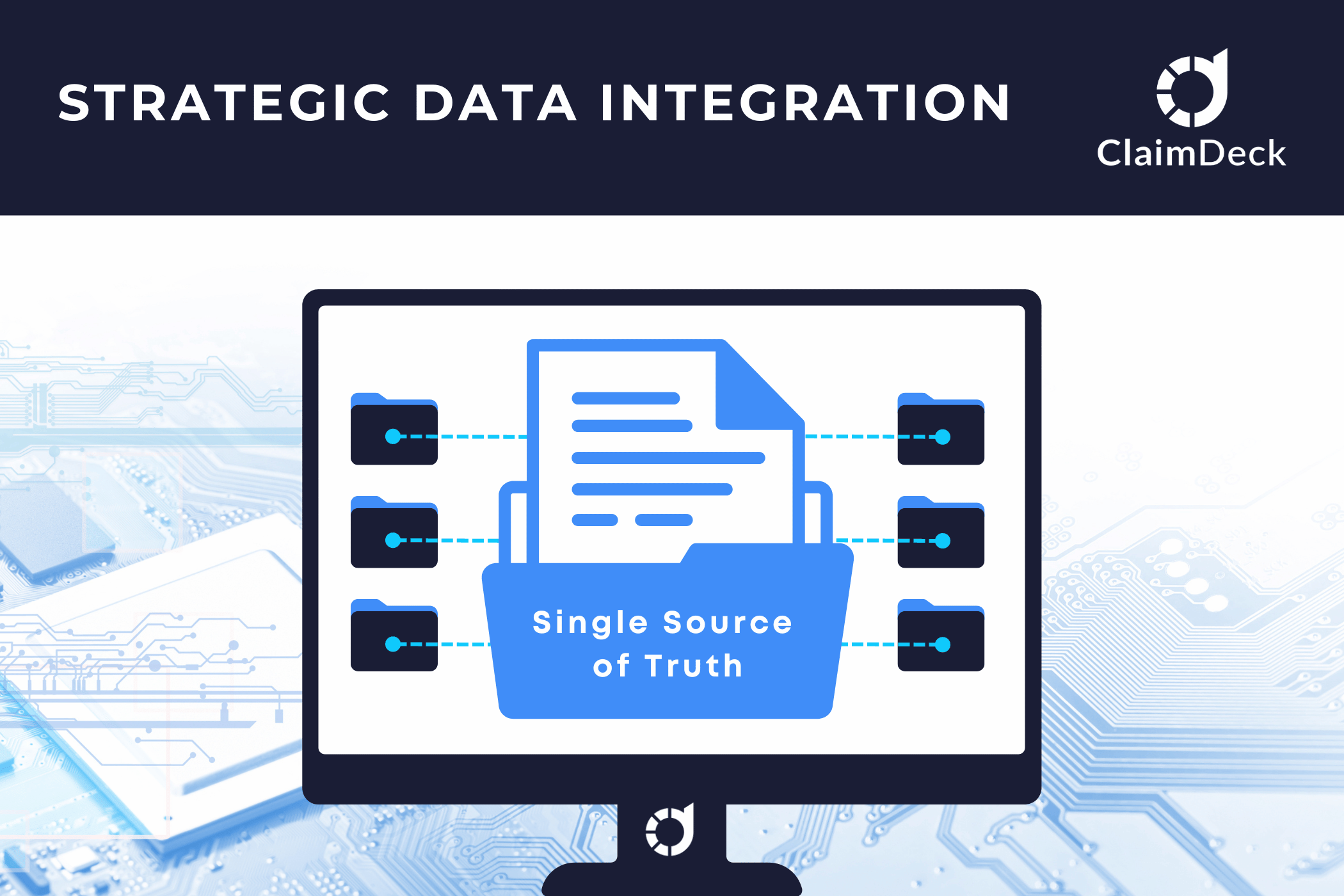

To counteract LitFin’s financial horsepower and tech‑savvy plaintiffs, insurers must deploy carrier‑centric platforms that unify, secure, and analyze their own claim data:

Centralized Case & Data Management

Single repository for all claim documents, correspondence, budgets, and event timelines.

Eliminates scattered email threads and siloed spreadsheets.

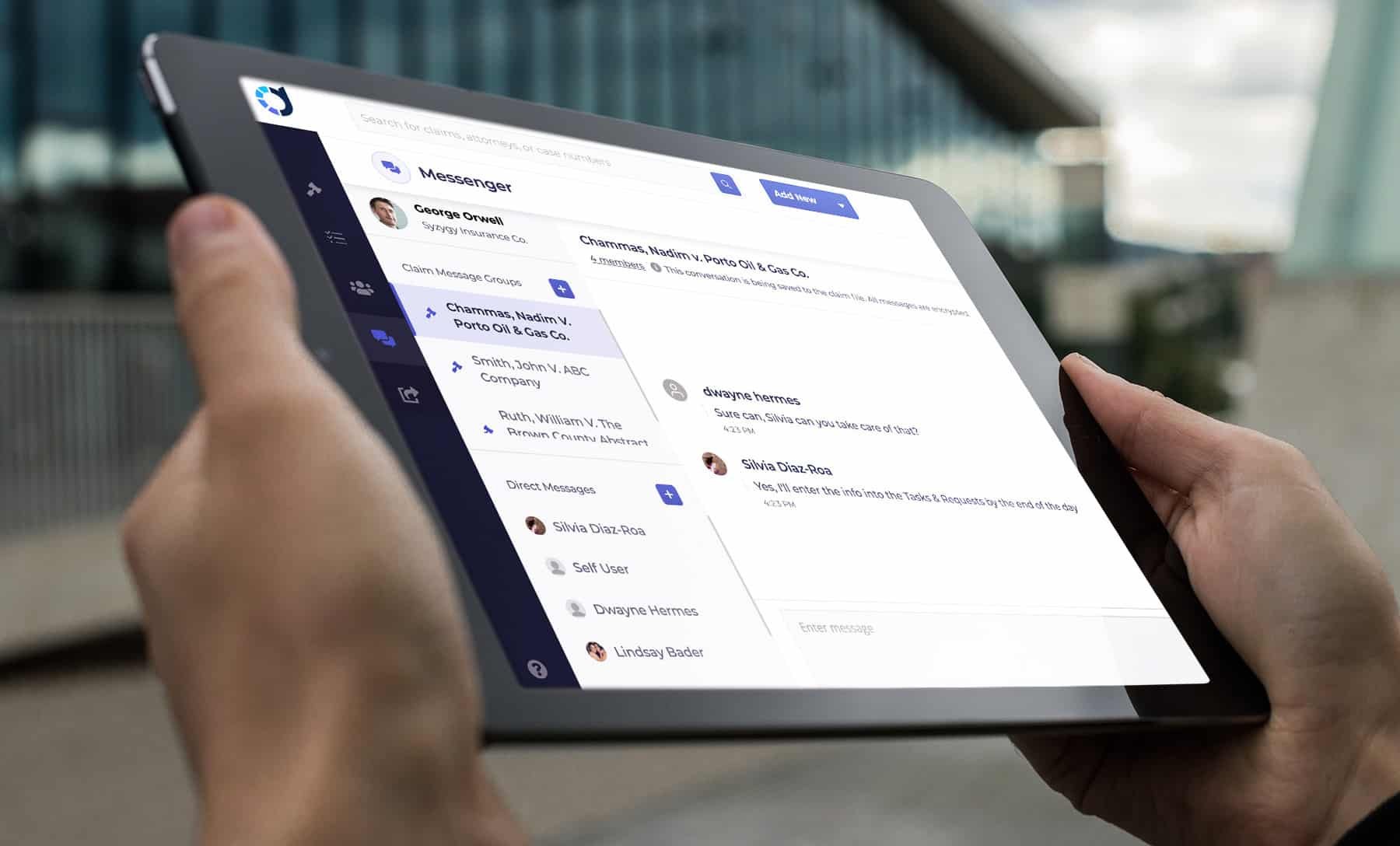

Real‑Time Collaboration & Transparency

Shared dashboards for adjusters, in‑house counsel, and panel firms—showing case status, budgets vs. actuals, and upcoming milestones.

Integrated “Tasks & Requests” and “Events & Important Dates” features that replace ad‑hoc bill‑review cycles with proactive workflow triggers.

Performance Measurement & Panel Oversight

Consistent KPIs—cycle time, cost per matter, resolution outcomes—tracked by firm and attorney.

Data‑driven panel selection, counsel rotation, and budget adjustments.

Predictive Insights & Early Triage

AI‑powered analytics on structured case data to identify high‑risk matters early, enabling targeted reserve setting and litigation strategy.

Scenario forecasting to evaluate potential jury trends and jurisdictional risks.

Embedded Compliance & Audit Trails

Litigation guidelines built into the platform with mandatory fields and automated alerts, documenting adherence and creating defensible audit logs.

Platforms designed and governed by carriers—rather than repurposing plaintiff‑focused tools—preserve institutional control, ensure data ownership, and align incentives with risk management goals.

Strategic Recommendations for Claims and Legal Leaders

Appoint a Defense‑Tech Orchestrator

A cross‑functional executive to champion claims‑tech integration, align IT and business, and oversee pilot‑to‑production rollouts.

Build a Data Foundation

Begin today by capturing granular, structured data on every litigated claim—hundreds of fields per matter—laying the groundwork for future AI.

Integrate & Consolidate

Rationalize existing point solutions; prioritize platforms that unify end‑to‑end workflows—from first notice of loss to final resolution.

Invest in Predictive Analytics

Develop in‑house or partner with vendors to apply machine learning on your unique data, forecasting verdict ranges, cost exposures, and optimal settlement windows.

Collaborate on Policy & Reform

Join industry coalitions advocating for funder disclosure mandates, tort‑reform measures, and balanced procedural rules that curb abusive claims financing.

Educate Stakeholders

Engage boards, investors, brokers, and policyholders on the long‑term cost implications of LitFin and the strategic value of defense‑side technology adoption.

From Insight to Action

Litigation finance and plaintiff‑side AI have reshaped the litigation landscape, fueling social inflation and creating an uneven playing field. Carriers and claims organizations cannot afford to be passive bystanders. Leading insurers have already begun cutting ties with LitFin‑linked vendors and pressing for transparency and reform.

Now is the time for claims and legal leaders to match the pace of innovation—by capturing their own data, deploying carrier‑centric litigation management platforms, and building predictive capabilities that safeguard profitability and public trust. Embrace this strategic blueprint, and your organization will not only mitigate the immediate threats of LitFin but also position itself at the forefront of a new era in efficient, data‑driven claims management.

See ClaimDeck in action!

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow Dwayne Hermes, ClaimDeck, and Hermes Law on LinkedIn.