AI is Reshaping Insurance — But Litigation Risk is Growing Faster

Why carriers can’t afford to let their most expensive claims phase fall behind

by Dwayne Hermes

The New Reality

AI is no longer a buzzword in insurance — it’s a budget line.

Big Tech companies are pouring billions into AI R&D, and investors are rewarding those who show practical AI integration (Reuters).

Agentic AI — autonomous AI that acts without prompts — is already appearing in claims workflows (Insurance Business Asia).

Insurers are exploring AI in underwriting, fraud detection, and catastrophe modelling (Insurance Business UK).

But here’s the paradox:

The most expensive, high-risk phase of many claims — litigation — remains the least digitized.

The Litigation Cost Surge

Even before AI, litigation was already a runaway cost center:

30–50% of total claim cost in many casualty portfolios comes from litigation (CLM Study 2024 – ClaimDeck).

Trial awards in personal injury and wrongful death cases have grown 7.6% annually, with awards over $5M nearly doubling since 2014 (RAND 2024 Social Inflation Study).

48% of litigation spend is avoidable — driven by miscommunication and admin delays, not case complexity (CLM Study 2024 – ClaimDeck).

At the same time, courts are backlogged and “nuclear verdicts” are on the rise, meaning high-severity cases are both more likely and more expensive (Insurance Thought Leadership).

The Data Quality Gap

In AI-driven insurance, data is the fuel — but litigation is running on fumes:

49% of insurers say data quality and availability are their top barriers to AI adoption (Insurance Thought Leadership).

Litigation files are still dominated by PDFs, free-text billing, and email chains — impossible for AI to learn from at scale.

Without structured, real-time litigation data, even the most advanced AI models are flying blind.

The Strategic Opportunity

Carriers already experimenting with AI in other claim areas can gain a competitive edge by making litigation data AI-ready:

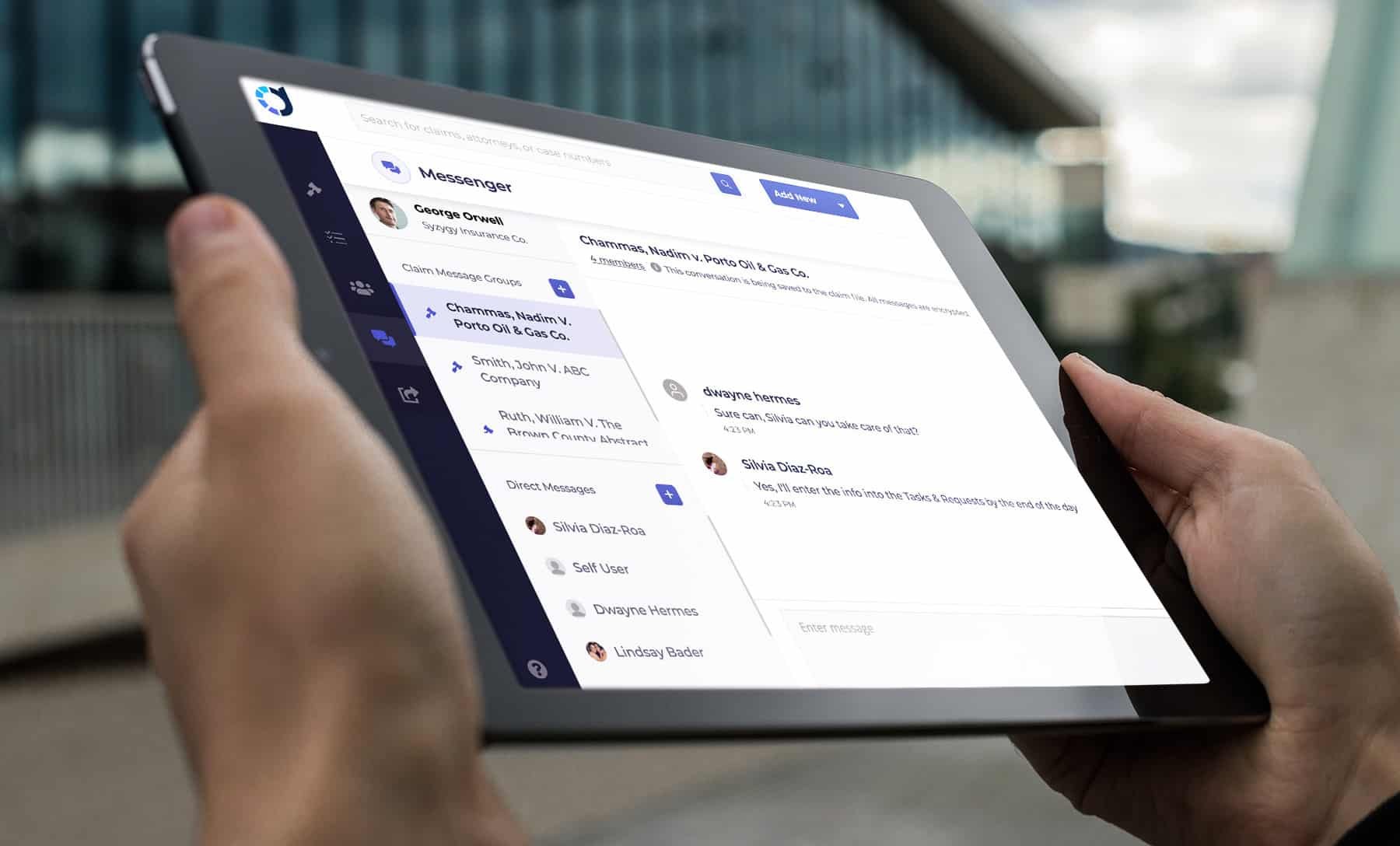

Structured milestones & compliance tracking

Real-time attorney performance insights

Early-warning signals for off-strategy cases

Data pipelines feeding predictive models and reserving tools

Platforms like ClaimDeck turn litigation from a black box into a live, measurable, strategic asset — reducing indemnity, controlling spend, and enabling AI to work where it matters most.

The AI Advantage Starts with Litigation

Litigation risk is no longer “just part of the job.” It’s growing — in frequency, severity, and strategic importance — at the exact same time AI is becoming the deciding factor in carrier competitiveness.

The carriers who win in this new era will be those who:

Treat litigation as a data source, not just a cost line

Build AI-ready litigation processes now, not after the fact

Use structured data to make faster, smarter, more defensible decisions

AI can change the game — but only if it can see the whole board.

Learn how ClaimDeck helps carriers cut case life by 200+ days, reduce spend, and make litigation AI-ready.

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow ClaimDeck on LinkedIn.