Ahead of the Curve: Plugging the Litigation Gap in Blueprint Two with ClaimDeck

PART 1

Why the Lloyd’s Market Needs to Address Its Litigation Blindspot

A personal perspective by Rebecca Side, Director of Sales, ClaimDeck

After more than 20 years in the London Market — watching adjusters chase down lawyers for updates, emails pile up like Jenga towers, and PDF invoices mysteriously multiply like gremlins — I’ve learned one thing:

Litigation isn’t just a process. It’s a black hole of uncertainty.

Now, along comes Blueprint Two — a digital revolution promising to rewire how we place risks, handle claims, and move data. APIs are replacing email chains. Digital bordereaux are replacing spreadsheets. Straight-through processing is no longer a fantasy — it’s fast becoming a standard.

And yet… litigation remains the market’s forgotten middle child.

Important.

Expensive.

And completely ignored at family meetings.

The Most Expensive Part of the Claim Still Lives in the 1990s

While Blueprint Two digitizes FNOL, policy placement, and even open market claim handling, it does not address the piece that often drives 30–50% of total claim cost: litigation. And this omission matters.

RAND’s 2024 Social Inflation study confirmed what many of us have felt in our bones for years:

Trial awards in personal injury and wrongful death cases have been rising at a 7.6% compound annual rate — well above economic inflation. Awards over $5 million have nearly doubled since 2014.

Litigation is not the exception. It’s a trend. And not the good kind — more “mullet revival” than fashion comeback.

The Assumption That Litigation Is ‘Out of Scope’ Must Be Reconsidered

We’ve heard it all before: “Litigation is rare. It’s handled by panel counsel. They’ve got it covered.” To which I say — with love — have they though?

The reality is that social inflation, complex liability trends, and an increasingly aggressive plaintiff bar mean litigation is growing in frequency and cost severity. Just ask the claims handlers I know who spend half their week trying to get a reserve update from outside counsel via email… or smoke signal.

In our Bridging the Gap survey, conducted by Fell Coaching & Consultancy:

72% of adjusters said they feel “in the dark” once a claim goes legal.

61% of attorneys admitted they don’t get clear strategies or expectations from the insurer.

That’s not a workflow. That’s a long-distance relationship with no communication plan.

As Oscar Wilde once said: “To expect the unexpected shows a thoroughly modern intellect.”

Unfortunately, in claims litigation, the “unexpected” still looks a lot like unanswered emails and surprise legal bills.

The Solution: Extend the Blueprint — Don’t Rewrite It

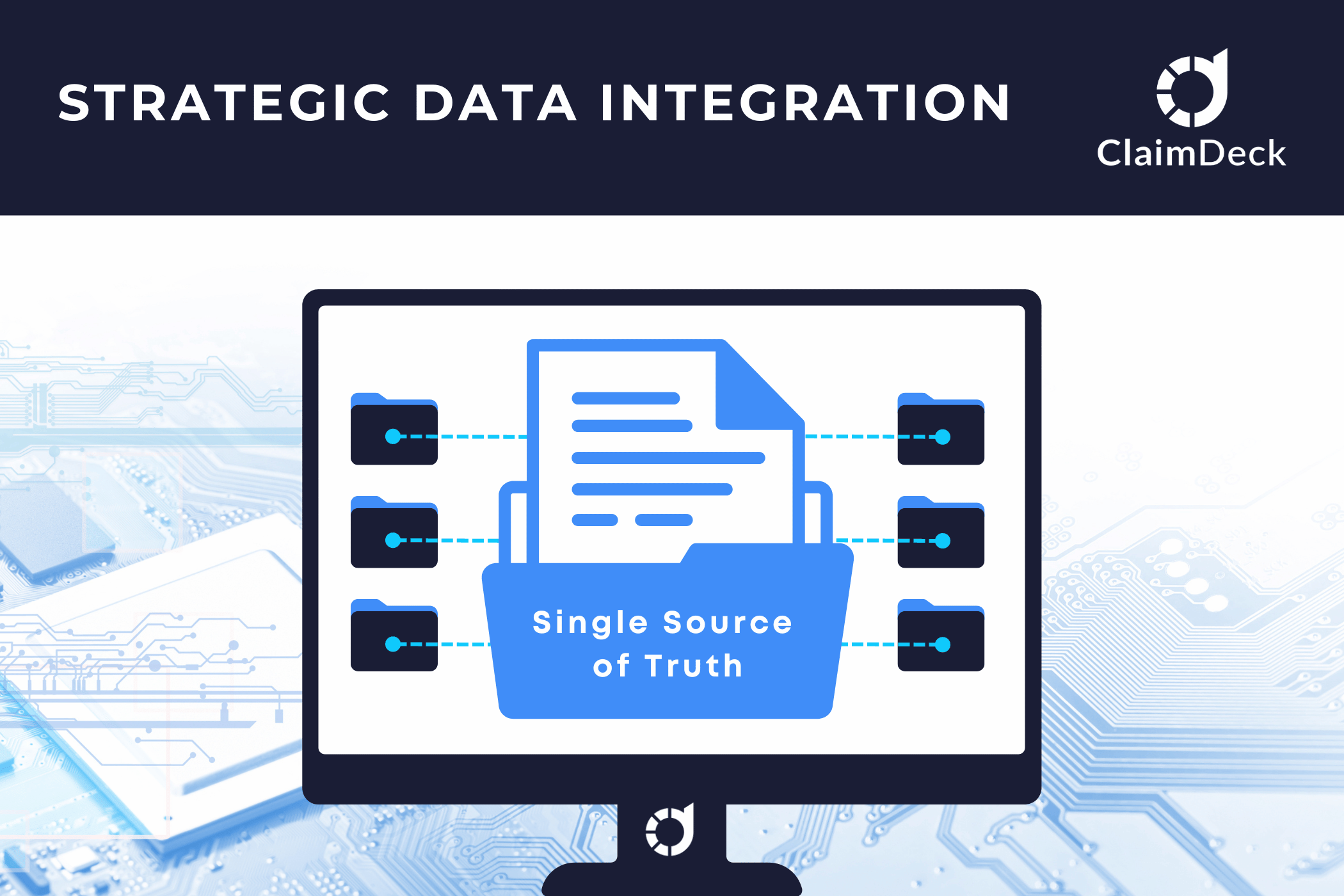

Blueprint Two has laid a strong foundation. But even the best blueprint needs an extension. Think of ClaimDeck as the digital annex for your litigation phase — fully integrated but built with modern tenants in mind.

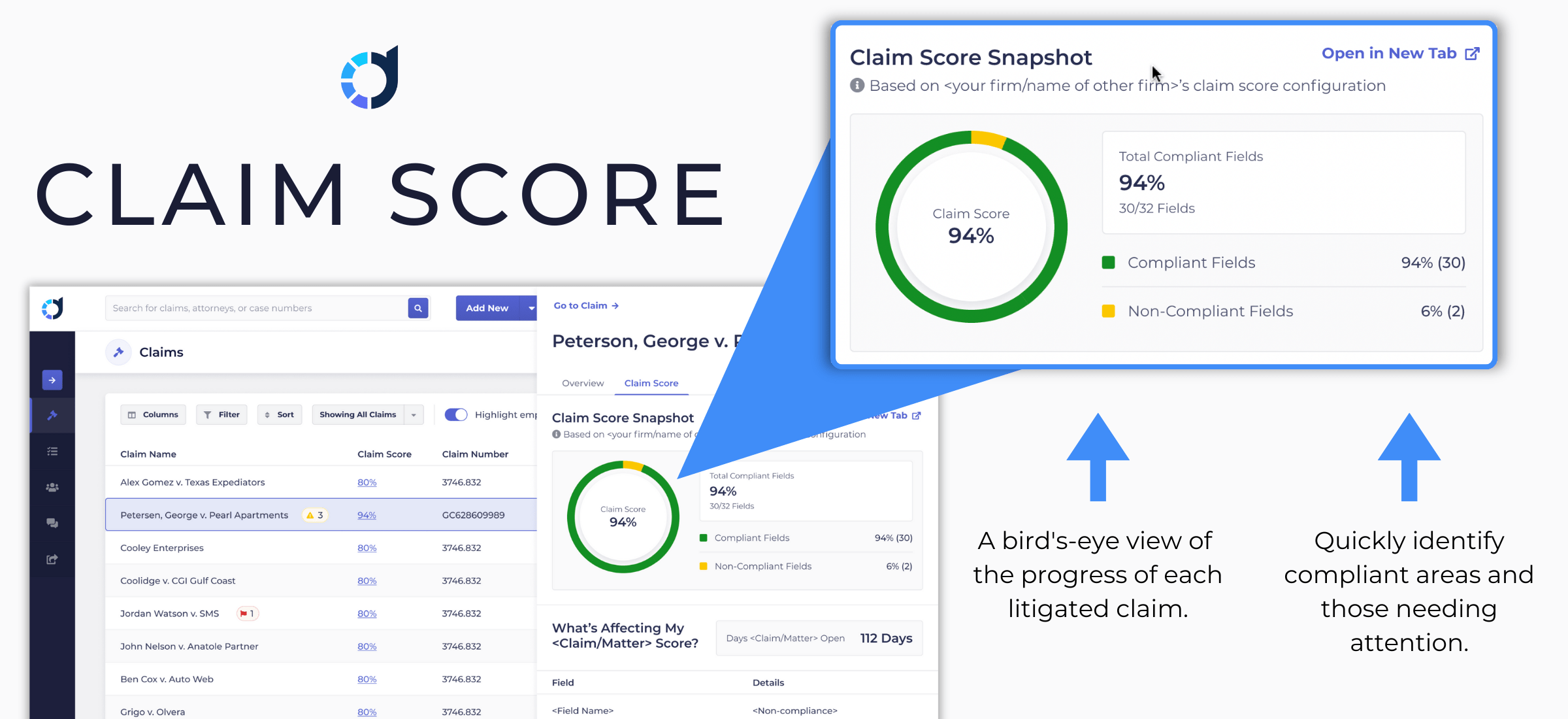

Here’s what we help syndicates do:

In other words, we don’t just help you log the case. We help you manage it, predict it, and — dare I say — improve it.

The Ask for the Market

So here’s the real question:

If the Blueprint is meant to “close the loop,” then why are we leaving the most expensive part of the loop open?

Litigation isn’t just a necessary evil — it’s where your costs, reputation, and strategic insight either flourish… or fall apart.

It’s time to extend the blueprint.

Or, as I often say to clients who’ve “got it covered”: If Excel is your litigation platform, you probably don’t.

Want to talk about how to plug the gap? You know where to find me.

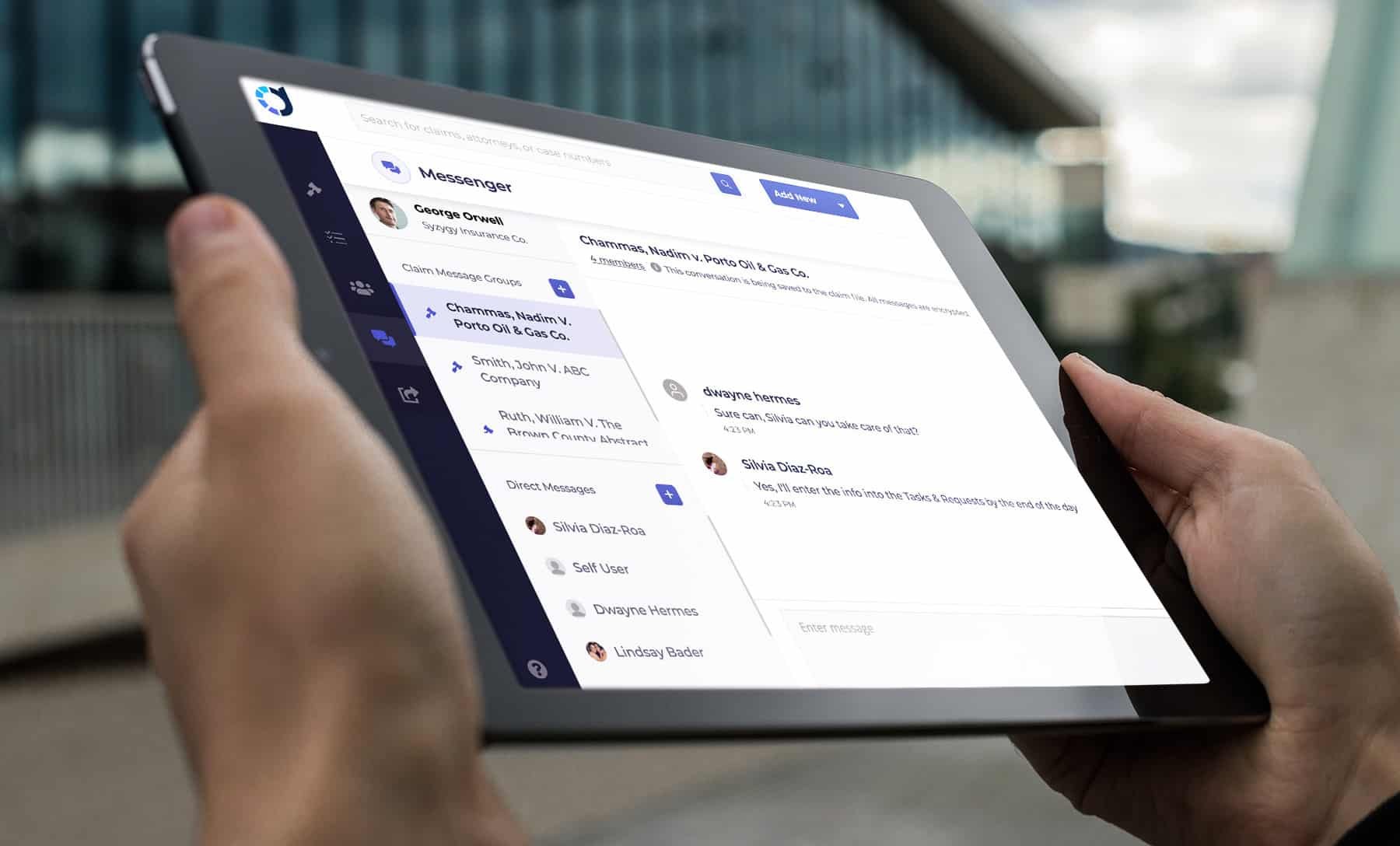

See ClaimDeck in action!

ClaimDeck™ eliminates claims litigation leakage for carriers while driving process into the law firm, modernizing the litigation process.

Follow ClaimDeck and Rebecca Side on LinkedIn.